Frictionless

Authentication

& Liability Shift

Just2pay's intelligent authentication system shifts liability

to the issuer and reduces customer friction by smartly

managing payment authentication.

Streamline payment

authentication worldwide

Streamline SCA, PSD2, and 3DS. Simplify authentication globally and adapt to region-specific regulations and behaviours to offer frictionless authentication everywhere.

Click to Pay simplifies online card payments to just one simple click

- Eliminate the need for your customers to enter payments data manually

- Seamless customer experience to improve checkout conversion rates

- Advanced security measures like network tokenisation and encryption

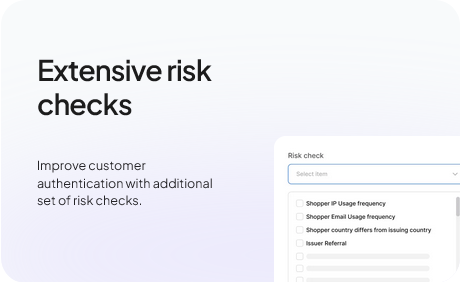

3DS engine that adapts to transaction & customer data

- Eliminate the need for your customers to enter payments data manually

- Configure 3DS triggers across transaction parameters

- Configure 3DS exempt & challenge flows as per your use cases

Apple Pay includes built-in SCA compliance and doesn’t require additional authentication

- Optimised pre-authorised payment experiences for recurring payments

- Payment cryptograms for dynamic security

Google Pay enables users to authenticate on their mobile devices without redirections

- Authentication via device-bound token and biometric/PIN

- SCA compliant and eligible for liability shift

Meeza consolidates consumer's cards into a single wallet for better authentication & experience

- Additional layer of security with network tokenisation

- Higher Approval Rates with network tokens

Streamlined card not present (CNP) authentication built to FIDO standards

- 1-click checkout experience with Device-based biometric payment authentication

- Can be used with EMV® 3-D Secure (3DS)

- Helps meet PSD2 SCA requirements in the EU

Streamlined Authentication experience for Bank Transfers

- Out of Band/Notification based flows

- Passkey based Authentication

- Time based One Time Password (TOTP) based Authentication

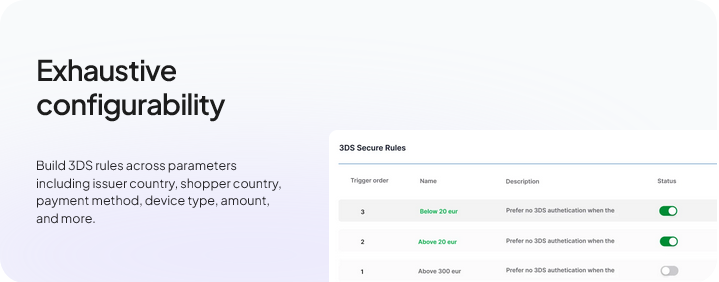

Adaptive payment flows based on

your data & fallback 3DS

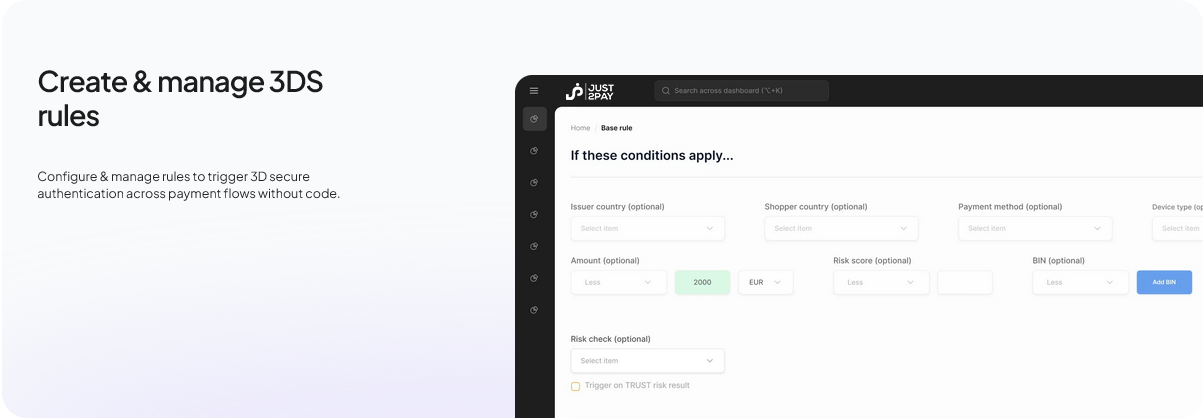

Take 360° control of

3DS authentication

Build your payment authentication strategy, control when 3DS is triggered, minimise payment fees and streamline customer experience.